|

|

How do you make a profit out of the market on a consistent basis? While most traders will either position or swing trade, the answer often lies with the technique of trading pairs. Pairs trading is independent of market direction, which makes it very attractive, and essentially relies on statistical phenomena where the psychology of crowds is reflected in regression to the mean - the tendency of behavior to revert to where it was previously. This technique is sometimes therefore known as statistical arbitrage. It is this technique too that underlies many Wall Street black box systems. At Psychonomics we advise on practical applications of pairs trading - as the technique doesn't only apply to stocks but to currencies, bonds, commodities, and indeed many financial markets where human behavior is the primary driver. Statistical arbitrage can also be used for trading ETF's as well as many other instruments. The analysis is straightforward, actually requiring very little in the way of statistics knowledge. Automated correlation scans are used and these allow items to be found that act very similarly or dissimilarly to each other. The correlation coefficients generated are a statistical measure that indicate how closely two curves move in the same way. The correlation coefficient has a value between -1 and +1. Values close to 1 show that the scanned item and reference item behave very similarly, while those close to -1 behave in an opposite manner. Values close to 0 indicate that the two items are not related at all. There are a number of ways to use this information:

A search is carried out to find two stocks that demonstrate a high correlation in prices with each other over a given period - a pair - and these are watched for divergencies from their paired path. You can check for these correlations using our stock correlation tool in the right-hand column (for subscribers with more advancd statistical knowledge we can also implement a similar tool for cointegration). The trick then is to wait until the two stocks you have chosen are just begining to move again in tandem with each other. This is the point at which a long position is taken in the stock rising upwards towards its mean and a short position is taken in the stock dropping towards its mean (in practice it may be a derivation of the mean that is used, such as mean difference, or it may be another line or measure where reversion is believed highly probable). Taking both a long and a short position in this way is referred to as a market neutral trade. It is usually news that causes the divergence, and you don't have to trade only a single stock. If one stock has good news and breaks out, you can trade closely-correlated stocks to it - usually from the same sector - knowing that there is a good liklihood they will very soon move in a similar way. If you played the stock with the good news directly you might only catch the tail-end of the move, whereas by buying its correlated partners you could catch a much larger part of the move in the laggards. You can trade dissimilar stocks off each other - if one has good news then you can go short on another, knowing that it should perform contrarily. You can balance your portfolio, making sure that you have a diverse set of items that will not be affected by each other. In this case you select items that are not well-correlated with each other. Although not a market neutral technique, you can trade a sector based on the stocks that are most or least correlated with it - getting either the very best (or worst) stocks in the sector. In order to do this effectively you need a good reason to believe that the sctor is going to move one way or the other.

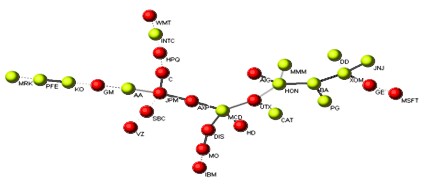

CorrelScan correlation tree for the Dow 30 stocks

| |||

| Find out more about portfolio construction strategies >> | ||||

| Find out more about investor psychology >> | ||||

|

||||